Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country.

It could also be thought of as a decrease in the value of your money and purchasing power.

There are three main causes of inflation: demand-pull inflation, cost-push inflation, and built-in inflation.

The latest numbers from the Bureau of Labor Statistics indicate that the rising inflation seen in 2022 could be slowing, in part thanks to lower gas prices, but the overall rate of inflation is still high: In July 2022, the Consumer Price Index increased 8.5% from a year ago.

In the US, the Consumer Price Index rose 6.8% between November 2020 and November 2021, spurred by price increases for gasoline, food, and housing. Higher energy costs caused the inflation to rise further in 2022, reaching 9.1%, a high not seen since 1981.

What is hyperinflation?. What is deflation?

Hyperinflation, when inflation is extremely high and typically accelerating (prices are rising rapidly and generally at an increasing pace), an economy experiences hyperinflation, which is usually associated with or can cause social upheaval and civil unrest. The best known example of hyperinflation occurred in Germany between World War I and World War II. More recent examples include Venezuela starting in 2017, Zimbabwe in the 2000s, and Yugoslavia in the 1990s. One common definition of hyperinflation is when inflation is more than 50 percent per month. In some extreme cases, hyperinflation can be so intense that prices double within a matter of days.

Deflation, while inflation imposes costs on a society, the opposite scenario, deflation—when the overall price level falls for a sustained period of time—can be costly, too. Deflation can change people’s behavior in ways that hurt the economy. If people think prices will go down in the future, they have less incentive to spend their income now. When prices fall, and people buy less, businesses might need to lower their employees’ wages or even lay off workers. These actions could then set in motion a “deflationary spiral” in which reluctance to spend leads to lower economic activity and a faster decline in prices, with the process then repeating itself.

Stagflation

Stagflation, Inflation plus slow (or declining) economic growth, usually accompanied by high unemployment.

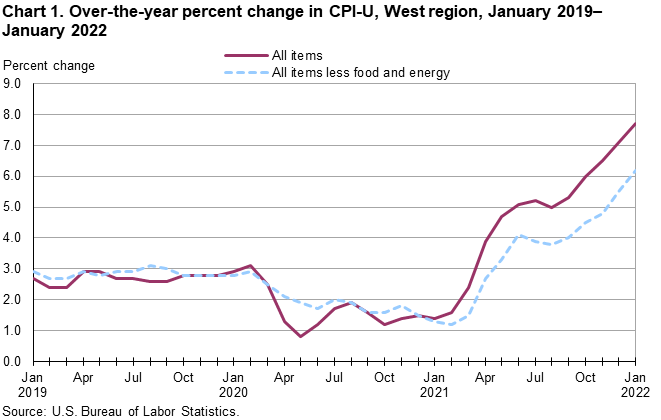

There are many ways of measuring inflation, but one of the most common measures is the Consumer Price Index for Urban Consumers (CPI-U), which is produced by the Bureau of Labor Statistics. The CPI-U shows changes in the prices paid by urban consumers for a “representative basket of goods and services.” or the most common goods and services purchased on an average month based on detailed surveys of what Americans spend their money on. The urban consumer group represents about 93% of the total US population.

Federal Reserve and inflation

The Federal reserve is the central bank of the U.S., and the Fed—like central banks around the world—is tasked with maintaining a stable rate of inflation.

The Federal Open Markets Committee (FOMC) has determined that an inflation rate around 2% is optimal employment and price stability.

Governments can control inflation through their monetary policy , interest rate, bank reserve requirement, supply of money.